The Smart card market size is projected to reach USD 16.9 billion by 2026, growing at a compound annual growth rate (CAGR) of 4.0% during the forecast period.

Major drivers for the growth of the market are surged demand for contactless card (tap-and-pay) payments amid COVID-19, proliferation of smart cards in healthcare, transportation, and BFSI verticals; increased penetration of smart cards in access control and personal identification applications; and easy access to e-government services and risen demand for online shopping and banking.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=285

Driver: Surged demand for contactless (tap-and-play) payments amid COVID-19

The consumer awareness about the benefits of tap-and-pay cards and the use of these cards was already trending upward before the pandemic. However, with the outbreak and the spread of the COVID-19, the use of contactless payments grew quickly. Amid the pandemic, which obligates limited contact and social distancing, people buy groceries, household items, etc., using contactless payment options. Consumers aim to limit their exposure during transactions. According to research carried out by Fiserv (US) in May 2020, people consider contactless (tap-and-pay) cards as the fastest and the safest way to pay.

Opportunity: New mode of information security of users enabled by blockchain

Blockchain is a revolutionary technology that helps businesses develop fast and secure applications that fulfill stringent security requirements. Smart cards can effectively manage cryptographic keys, thereby enabling efficient and secure transactions in blockchain applications. They act as vaults for storing cryptographic keys. When smart cards are connected to the Internet through POS readers, the keys stored in them can be matched with keys stored in online libraries. If the match is successful, users are authenticated. This is expected to help banks and other ecosystem players secure and authenticate the identity of users in an improved manner, thereby reducing instances of cyber thefts.

Challenge: Risen proliferation of digital identity cards

Digital identity cards are the electronic equivalent of identity cards. Unlike paper-based identity cards such as driving licenses and passports, digital identity cards can be authenticated remotely over digital channels. This results in unlocking their access to banking services, government schemes, educational facilities, etc. It is expected that in the next three to four years, mobile devices will serve as digital identity cards to access enterprise services and data.

Monday, October 9, 2023

Smart Card Market Size, Opportunities, Share, Leading Players, Revenue and Forecast 2026

Subscribe to:

Post Comments (Atom)

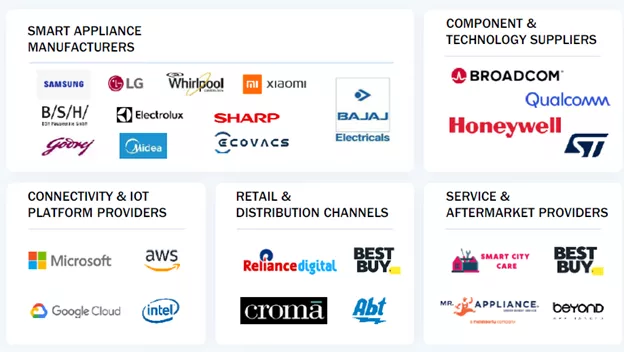

Smart Home Appliances Market: Revolutionizing Modern Living Through Connected Intelligence to 2030

The Connected Home Revolution Smart home appliances are becoming a central pillar of modern households as consumers increasingly adopt conne...

-

In the ever-evolving landscape of industrial automation, ensuring the safety of workers and machinery is paramount. Machine safety solutio...

-

The global 3D machine vision market is expected to be valued at USD 2.13 Billion by 2022, growing at a CAGR of 11.07% between 2017 an...

-

Major factors driving the market for AI infrastructure include increasing adoption of cloud machine learning platform, escalating demand f...

No comments:

Post a Comment