The

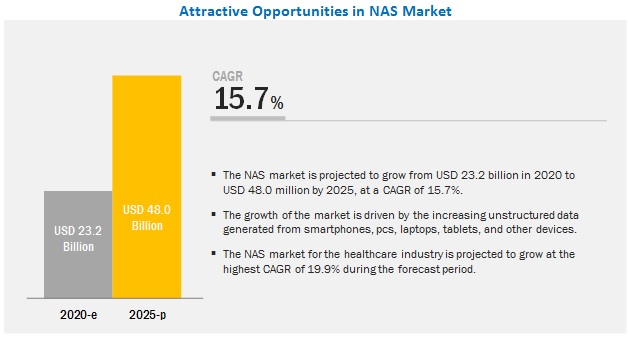

global network

attached storage market is projected

to grow from USD 23.2 billion in 2020 to USD 48.0 billion by 2025 at a CAGR of

15.7%. One of the factors fueling the growth of this

market is the increased use of smartphones, laptops, and tablets, resulting in

the generation of large volumes of data.

Network

attached storage is a dedicated storage device with

multiple racks of storage media and is set

up onto a dedicated network for storing the data. NAS devices are connected

directly to the network and can give data

access to multiple authorized users at the same time. These are highly reliable,

scalable, and cost-effective data storage solutions available to various

end-user industries in the market.

Download PDF Brochure:

In 2019, 1-bay to 8-bay NAS solutions accounted for the largest market

share and a similar trend is expected to be observed during the forecast period. 1-bay

to 8-bay NAS systems are in demand from various end

users, such as education and research centers, business and consulting firms,

small and medium-sized businesses, and media and entertainment companies.

Based on product, midmarket NAS solutions are likely to

continue to dominate the market during the forecast period. The growing demand

for midmarket NAS solutions from home offices, as well as small and mid-sized offices

and risinguse of smart devices such as smartphones, wearables, and gaming systems are the key

reasons for the growing demand for midmarket NAS solutions.

In 2019, the

scale-up NAS segment held a majority of the NAS market. The growth of this

segment can be attributed to the surge in the deployment of scale-up NAS systems

in homes, educational institutions, small and medium-sized offices,and hotels,

wherein a moderate volume of data is generated,

and the only requirement is to store this data.

In 2019, the on-premises

segment held the largest share of the NAS market. This deployment is generallyfavoredby end-usersas it offers high

security and control over data management to its users. Moreover, this model utilizes

in-house hardware and software, which ensures the safety, privacy, and security

of stored data.

Based on end-user industry,

the BFSI segment held the largest share of the NAS market in 2019. The growth

of this segment can be attributed to the rising government initiatives to implementdigital

practices in business; increasingawareness among people about employing various

smart banking tools,such as internet banking, mobile banking, automated teller

machines (ATMs) and debit cards, and online payments through multiple apps including GooglePay, PhonePe,

Paytm, WeChat, and Zeta, as well as rapidly changing human lifestyle.

Request More Details:

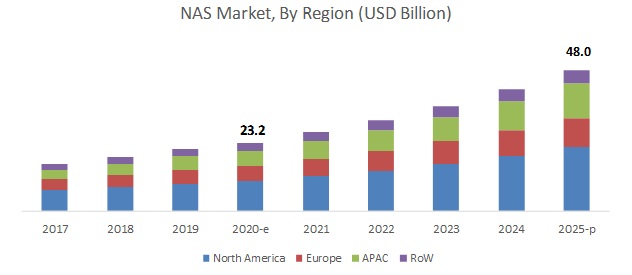

In 2019, North America accounted for the largest share of the network attached storage market. The growth of the NAS market in North America can be attributed to the fact that the region is home to leading producers such as Dell Technologies Inc., NetApp, Inc., and HEWLETT PACKARD ENTERPRISE COMPANY (HPE), as well as majorconsumerssuch as Syracuse University, UNICOM Global, Tufts University, and Linn Benton Lincoln of NAS solutions. Moreover, North America, being the early adopter of advanced data storage technologies, it captures the largest share of the NAS market, followed by Europe and APAC.