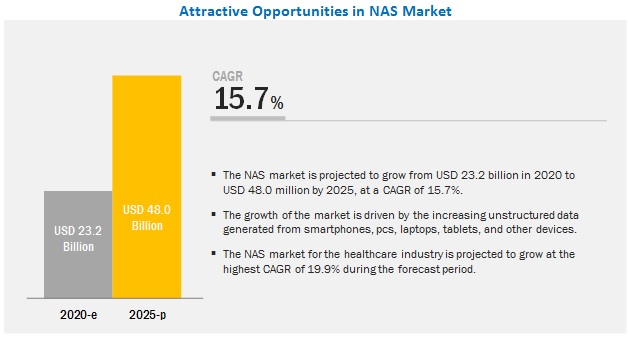

According to the new

market research report "Network Attached Storage (NAS)

Market with COVID-19 Impact Analysis, by Design (8 bays to 12 bays, More

than 20 bays), Product (Enterprise, Midmarket), Storage Solution (Scale-up,

Scale-out), Deployment Type, End-user Industry, & Geography - Global

Forecast to 2025", published by MarketsandMarkets™, the global NAS

market is estimated to grow from USD 23.2 billion in

2020 to USD 48.0 billion by 2025, at a

CAGR of 15.7%. The increased use of smartphones, laptops, and tablets resulting

in the generation of large volumes of data and the rapid adoption of 4G and 5G

technologies are the key factors fueling the growth of this market.

Market for 1-bay to

8-bay NAS solutions accounted for largest share of NAS market in 2019

In 2019, NAS systems

with 1 bay to 8 bays held the largest market share, and a similar trend is

likely to be observed during the forecast period owing to the growing adoption

of 1-bay to 8-bay NAS solutions by small and medium-sized businesses, homes,

education and research centers, media and entertainment companies, and business

and consulting service providers. An increase in the volume of data generated

across these industries, is leading to the increased demand for 1-bay to 8-bay

NAS solutions.

Market for midmarket

NAS solutions is expected to grow at highest CAGR during forecast period

The midmarket NAS

solutions held a larger market share in 2019, and a similar trend is likely to

be observed in the near future. It is also projected to grow with a higher CAGR

during the forecast period. The increased use of smart devices products such as

smartphones, tablets, and other smart devices led to the rise of digital media.

Midmarket NAS solutions are ideal and inexpensive solutions for small- and mid-sized

businesses and homeowners.

Market for scale-up

NAS solutions accounted for largest share of NAS market in 2019

Scale-up NAS

solutions held a larger market share in 2019. These solutions are usually

deployed in industries such as small and medium-sized offices, homes,

educational institutions, and hotels, wherein a moderate volume of data is

generated, and the only requirement is to store this data. Also, these

solutions are available at a lower cost compared to scale-out solutions.

Market for hybrid

deployment is expected to grow at highest CAGR during forecast period

The hybrid segment

is expected to register the highest CAGR in the NAS market during the forecast

period. The hybrid system consists of both on-premises and remote deployments

where active data is stored in the on-premises system, and inactive data is

shifted to remote location-based systems. The inclination toward such

deployment models is increasing day by day as companies need to keep a backup

of the crucial data to avoid the loss of critical information in the case of

any disaster.

113 – Tables

60 – Figures

197 – Pages

Banking, financial

services, and insurances (BFSI) industry accounted for largest share of NAS

market in 2019

In 2019, the BFSI

industry held a major share of the NAS market. Large volumes of data is being

generated in the BFSI industry; hence, the industry requires reliable and huge

capacity storage devices to store generated data. These requirements can be

fulfilled by NAS devices. Moreover, data security is a major concern of the

players in this industry. Therefore, they are focused on using highly scalable

and reliable NAS solutions to avoid security-related issues.

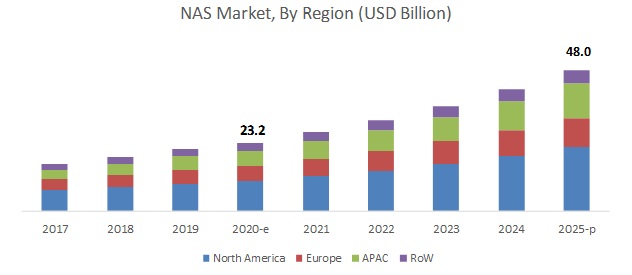

Market in APAC is

expected to grow at highest CAGR during forecast period

The market in APAC

is expected to grow at the highest CAGR duNetwork Attached Storage Marketring the forecast period owing to the

presence of numerous small and mid-scale industries in the region. Also, the

increasing number of small and medium-sized enterprises (SMEs) and increasing

investments by these companies on the development of IT infrastructure are

driving the growth of the NAS market in these countries.

Dell Technologies Inc.

(US), NetApp, Inc. (US), HEWLETT PACKARD ENTERPRISE COMPANY (HPE) (US),

Hitachi, Ltd. (Japan), and WESTERN DIGITAL

CORPORATION (US) are the key players in the NAS market. These players are

increasingly undertaking strategies such as product launches, expansions,

partnerships, contracts, collaborations, agreements, and acquisitions to

increase their market share.

No comments:

Post a Comment