The plant asset management market is expected to grow from USD 5.5 billion in 2019 to USD 9.4 billion by 2024, at a CAGR of 11.3%.

The market’s growth is propelled by surging adoption of lean manufacturing practices by several organizations, increasing focus on providing cloud-based PAM solutions to satisfy customer demands, escalating demand for asset management software that can identify potential failures to avoid futuristic loss, and growing need for real-time data analytics.

PAM market in APAC is expected to grow at the highest CAGR during the forecast period. The adoption of PAM solutions is high in APAC due to the growing manufacturing sector in the region.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=8606975

Emerson Electric Co. (U.S.)

Emerson Electric Co. manufactures and develops process controls, systems, valves, and analytical instruments. The company offers industrial, commercial, automation, and residential solutions worldwide. It operates through 2 business segments—Automation Solutions and Commercial & Residential Solutions. The company has 220 manufacturing locations in 150 countries, primarily in Europe and Asia. Emerson Electric provides PAM solutions under its Automation Solutions segment. It serves industries such as petroleum, chemicals, food & beverages, pulp & paper, pharmaceuticals, and water & wastewater treatment. The company focuses on expanding its product portfolio and improving its offerings to meet the ever-changing needs of its customers across various end-user industries. For instance, in July 2019, the company modified its AMS Device Manager Software solution with HART-IP support, and in September 2019, Emerson launched the AMS Asset Monitor edge analytics device.

Rockwell (US)

Rockwell Automation, Inc. is one of the world’s largest companies providing industrial automation power, control, and information solutions. The company operates in 2 major business segments, namely, Architecture & Software and Control Products & Solutions. The Architecture & Software segment includes hardware, software, and communication components of the company's integrated control and information architecture capable of controlling customers’ industrial processes and connecting with their manufacturing enterprise. Rockwell Automation has a strong market position in the asset management field. Rockwell emphasizes on product improvements. For instance, in July 2019, the company upgraded its FactoryTalk AssetCentre Software to protect a wider range of assets. Moreover, the company is aggressively involved in mergers and acquisitions to increase its market share in countries other than the US. In October 2019, Rockwell acquired MESTECH Services to expand its consulting and system integration scale in the fast-growing transformation market.

ABB Ltd. (Switzerland)

ABB Ltd., a global leader in power and automation technologies. The ABB Group was founded in 1988 after the merger of Asea AB (Sweden) and BBC Brown Boveri AG (Switzerland). It operates mainly in areas such as robotics, power, heavy electrical equipment, and automation technology. The company has presence in Europe, the Americas, Asia, Africa, and the Middle East. ABB mainly operates in 3 business segments—Electrification Products, Robotics and Motion, and Industrial Automation. The company strives to increase its profit margin by strengthening its product competitiveness, adopting inorganic strategies, and lowering market-related risks. ABB has launched ABB Ability drives to accelerate profitable growth. A significant portion of ABB’s R&D investments is utilized for its Industrial Automation business segment, which develops PAM solutions. In addition, ABB significantly invests in R&D to thrive in a competitive environment. In FY 2018, its R&D expenditure was USD 1.2 billion, that is, 4.1% of its total revenue. Further, the company is capitalized on partnerships with other professional third-party solution providers to ensure mutual profit and growth.

Monday, September 11, 2023

Plant Asset Management Market Revenue, Opportunities, Challenges and Key Players

Subscribe to:

Post Comments (Atom)

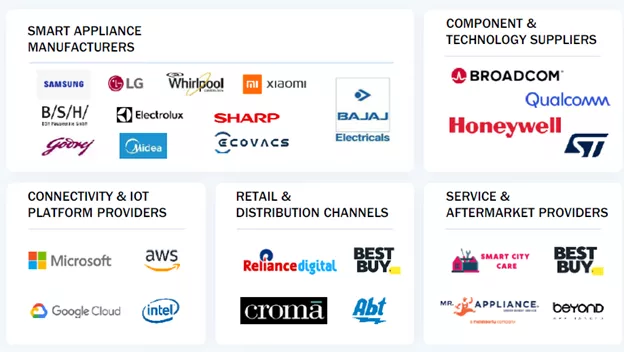

Smart Home Appliances Market: Revolutionizing Modern Living Through Connected Intelligence to 2030

The Connected Home Revolution Smart home appliances are becoming a central pillar of modern households as consumers increasingly adopt conne...

-

In the ever-evolving landscape of industrial automation, ensuring the safety of workers and machinery is paramount. Machine safety solutio...

-

The global 3D machine vision market is expected to be valued at USD 2.13 Billion by 2022, growing at a CAGR of 11.07% between 2017 an...

-

Major factors driving the market for AI infrastructure include increasing adoption of cloud machine learning platform, escalating demand f...

No comments:

Post a Comment