The Non-volatile memory (NVM) market is projected to grow to USD 124.1 billion by 2027 from USD 74.6 billion in 2022; growing at a CAGR of 10.7% from 2022 to 2027. The market is driven by the increasing demand for high-speed, low-power, and reliable memory solutions. Non-volatile memory is a type of computer memory that can retain data even when the power is turned off, unlike volatile memory such as RAM.

Smart technologies and consumer electronics are key end users of non-volatile memory. High-capacity memory solutions with a high data transfer rate are used in various connected devices, wearable devices, and other portable devices to store data.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1371262

Opportunity: Advent of innovative technologies for IoT applications

The increasing replacement of traditional memories with emerging non-volatile memories offers a significant opportunity for market players. Traditional memory technologies, such as DRAM and flash, have captured a major share of the memory technology market. The Non-Volatile Memory Industry is currently experiencing a significant shift as emerging technologies are increasingly replacing traditional memories like DRAM and flash. Traditional flash memories have limitations, such as slow switching rate, high latency, and low scalability. They face limitations of scalability below 90 nm while using floating gate technology and consume more power than other emerging memory technologies. Currently, flash memories are being used in smartphones, tablets, and PDAs. The major alternatives to flash memories are 3D NAND, ReRAM, NRAM, and MRAM, which are superior to flash memories in terms of latency, switching time, endurance, write cycle, and data retention. AI and IoT integrated solutions are major users of such technologies. A NVM that supports fast writes and can be shut down fully but quickly restarted. MRAM is a good fit for the IoT and AI use cases since it has better capacity, density, power requirements, quick writing performance, and extremely low read latency. While ReRam is suited for in-memory computing. A second-generation ReRAM device is being developed in collaboration between Fujitsu and Panasonic. Additionally, SMIC (China) is developing a 40 nm ReRAM technology that Crossbar Inc. is sampling.

Challenge: Optimization of storage densities and capacities

Memory storage density stores the information bits on a computer storage medium. Higher-density memory is more in demand as it allows greater volumes of data to be stored in the same physical space. Thus, storage density directly correlates with a given medium’s storage capacity. Storage density also has a fairly direct effect on performance and price.

Wednesday, September 6, 2023

Non-Volatile Memory (NVM) Market Emerging Trends, Growth Drivers, Strategies, Forecast to 2027

Subscribe to:

Post Comments (Atom)

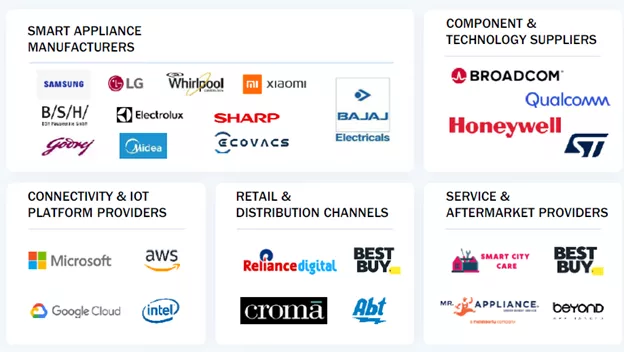

Smart Home Appliances Market: Revolutionizing Modern Living Through Connected Intelligence to 2030

The Connected Home Revolution Smart home appliances are becoming a central pillar of modern households as consumers increasingly adopt conne...

-

In the ever-evolving landscape of industrial automation, ensuring the safety of workers and machinery is paramount. Machine safety solutio...

-

The global 3D machine vision market is expected to be valued at USD 2.13 Billion by 2022, growing at a CAGR of 11.07% between 2017 an...

-

Major factors driving the market for AI infrastructure include increasing adoption of cloud machine learning platform, escalating demand f...

No comments:

Post a Comment