Embedded Subscriber Identity Module (eSIM), also referred to as Embedded Universal Integrated Circuit Card (eUICC), is a reprogrammable chip that comes in either soldered or removable form. It is a small chip used to authenticate the user’s identity with his or her carrier. eSIM is smart in terms of its functionality as it supports multiple accounts, allows switching to various mobile network operators (MNOs), and manages accounts just by updating the software settings from the user’s mobile phone.

The overall eSIM market was valued at USD 253.8 Million in 2017 and is estimated to reach USD 978.3 Million by 2023, at a CAGR of 31.0% between 2018 and 2023. In terms of volume, the overall eSIM market registered a shipment of 287.7 million units in 2016 and is likely to witness a shipment of 1,168.8 million units by 2023, at a CAGR of 32.4% between 2018 and 2023.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=69178757

Based on application, the overall eSIM market has been segmented into connected cars, laptops, M2M, smartphones, tablets, wearables, and others. The M2M application is expected to hold the largest size of the market during the forecast period due to the several advantages offered by the implementation of eSIM in M2M devices including simpler device setup without the need to insert or replace a SIM card, improved reliability and security, sleek design, and no requirement of a connector.

The eSIM market in APAC is expected to witness the highest CAGR between 2018 and 2023. The smartphone adoption rate is rising steadily in this region, and it is evident that in terms of smartphone adoption, 3 out of the top 5 countries worldwide are APAC countries that include Australia, Singapore, and South Korea.

Smart solutions, such as electric vehicles, smart cities, and smart meters, are increasingly adopted across the world due to the flexibility and connectivity offered by the IoT infrastructure and accelerated push for smart cities and infrastructure growth in emerging economies. The evolution and expansion of networks, reduced cost of hardware components such as sensors and actuators, and the emergence of new business models are some of the key factors that will lead to the introduction of services such as deployment of smart grids, automatic security systems, connected cars.

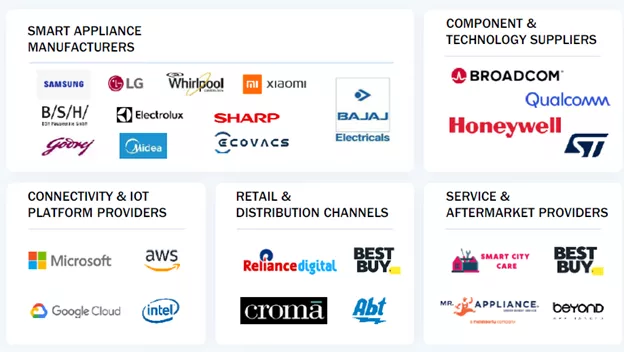

ESIM value chain is highly complex and involves multiple stakeholders. Due to this, stakeholders are required to coordinate and cooperate for setting standards concerning economies of scale, interoperability, and IoT technologies, including machine-to-machine communications and ubiquitous sensor networks for the effective implementation of embedded SIMs across myriad applications.

Tuesday, July 11, 2023

eSIM Market Size 2023: Industry Share, Growth, Demand, Challenges, Top Manufacturers

Subscribe to:

Post Comments (Atom)

Smart Home Appliances Market: Revolutionizing Modern Living Through Connected Intelligence to 2030

The Connected Home Revolution Smart home appliances are becoming a central pillar of modern households as consumers increasingly adopt conne...

-

In the ever-evolving landscape of industrial automation, ensuring the safety of workers and machinery is paramount. Machine safety solutio...

-

The global 3D machine vision market is expected to be valued at USD 2.13 Billion by 2022, growing at a CAGR of 11.07% between 2017 an...

-

Major factors driving the market for AI infrastructure include increasing adoption of cloud machine learning platform, escalating demand f...

No comments:

Post a Comment