Display driver market share is estimated to grow from USD 7.1 billion in 2018 to USD 9.1 billion by 2023, at a CAGR of 5.1% between 2018 and 2023.

The market is growing due to the increasing demand for OLED and flexible displays, adoption of highly priced and advanced display drivers, and growth in the automotive display market. Growth in the use of 4K and 8K televisions and availability of UHD content, and evolving role of DDICs in individual components and single integration chips also drive the growth of the market for display driver ICs.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=60452441

The OLED display driver market is expected to grow rapidly during the forecast period which will eventually increase the demand for high-performance display driver ICs and subsequently drive the market toward higher growth. OLED and flexible displays are trending in the display market due to their increasing adoption in smart devices such as smartphones, wearables (smartwatch, AR/VR HMDs), and smart TV. South Korea accounts for more than 95% of total OLED display panel production, owing to which majority of OLED-based display driver demand is emerging from South Korea. With huge investments from Samsung and LG Display in OLED technology and their production expansion, South Korea is expected to dominate the market for OLED displays, in terms of size, during the forecast period.

A majority of display driver demand comes for LCD and OLED displays. These displays are produced in Asia Pacific, especially in countries such as China, South Korea, Japan, and Taiwan. Construction of Gen 6 and above facilities by Chinese players, with government support in terms of finance and land offerings, can have a significant impact on the global display panel market. This will increase the production of LCD and OLED displays in China and subsequently increase the demand for display drivers for a majority of the applications. The increasing adoption of OLED displays by Chinese smartphones vendors, and TV and smart wearable device manufacturers is boosting the demand for OLED display panels in the country also the favorable and cost-effective manufacturing environment in the country is facilitating the increase in the display panel production in China.

Small devices account for the highest demand of display drivers. Display panels are used in several small devices such as smartphones, automotive displays, tablets, feature phones, industrial displays, small medical devices, camera, and others. Automotive displays are expected to witness positive growth in terms of shipments during the forecast period. Smartphone is one of the leading devices accounting for a majority of the global display drivers market. The market in small devices is expected to be driven by the smartphone segment during the forecast period. Smartphone display panels are produced in the range of 1.5–1.7 billion units yearly. With innovation in display technology (LTPS-LCD and OLED), the rapid adoption of flexible display panels, and the introduction of full-view displays in smartphones, demand for TDDI and COF-based display drivers is expected to increase rapidly in the next 2 years.

Friday, June 23, 2023

Display Driver Market Size, Share, Growth, Trend, Forecast 2023

Subscribe to:

Post Comments (Atom)

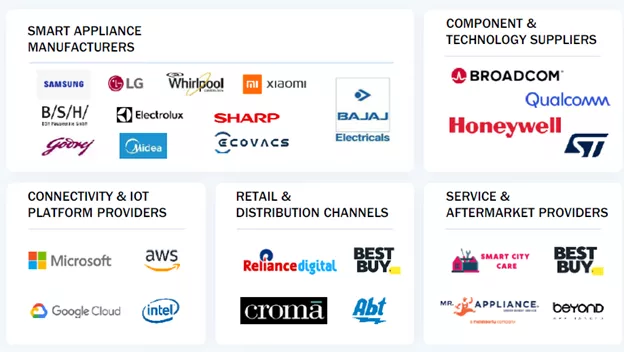

Smart Home Appliances Market: Revolutionizing Modern Living Through Connected Intelligence to 2030

The Connected Home Revolution Smart home appliances are becoming a central pillar of modern households as consumers increasingly adopt conne...

-

In the ever-evolving landscape of industrial automation, ensuring the safety of workers and machinery is paramount. Machine safety solutio...

-

The global 3D machine vision market is expected to be valued at USD 2.13 Billion by 2022, growing at a CAGR of 11.07% between 2017 an...

-

Major factors driving the market for AI infrastructure include increasing adoption of cloud machine learning platform, escalating demand f...

No comments:

Post a Comment