The embedded security market size is valued at USD 6.8 billion in 2022 and is anticipated to be USD 9.0 billion by 2027; growing at a CAGR of 5.9% from 2022 to 2027.

Driver: Inclusion of payments functionality in wearables

Wearable technology is evolving and developing, with everything from clothing to smart glasses to jewelry to virtual reality (VR) tools (such as the Oculus Rift) being a part of it. Smart wearable technology is being employed in a variety of applications, including fitness tracking, navigation, and health monitoring. To avoid misuse, several of these apps, such as payments and smart home control, require user authorization. Embedded security solution companies are releasing new embedded security solutions to meet this niche market. For instance, STMicroelectronics (Switzerland) offers secure wearable solutions for a variety of applications, including payment, transportation, and contactless transactions. Axis Bank and Thales Group collaborated to launch "Wear N Pay," a range of contactless payment devices.

Ask for PDF:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=63839062

Restraint: Susceptibility of embedded systems to cyber-threats and security breaches

One of the main issues hindering the growth of the embedded security market is the security of embedded devices. Military forces, banks, data centers, and healthcare institutions may utilize information stored in embedded devices such as memory. As a result, protecting such devices against cyber-attacks and data breaches is critical. Because of irregular security upgrades, a long device lifecycle, remote deployment, and attack replication, embedded systems are vulnerable to cyberattacks. As a result, the market's growth is expected to be hampered by its susceptibility to cyber-attacks and security breaches.

Opportunity: Growing Integration of embedded security in electric vehicles

Many innovations in the automobile sector are currently dependent on software and electronics, and IT is likely to contribute to a large percentage of the production cost. The EV market is expanding rapidly because it offers advantages over other types of vehicles. However, from the standpoint of charging infrastructure, EV charging is considerably more than a one-step, plug-and-go procedure. To ensure that every EV on the grid receives the necessary quantity of energy and electrical flow, a significant amount of communication must take place between the car, the charging point, and the utility supplier. Financial transactions and personal data should be managed responsibly and securely in some circumstances, particularly where remote EV charging is given for a fee.

Challenge: Shortage in supply of semiconductors

Semiconductors are a major component of embedded systems. The global supply chain was disrupted as a result of the 'trade war' between the United States and China. Tariffs and restrictions were placed by the two countries on each other, causing demand and supply disruptions. Supply chain disruptions have impacted multiple industries, resulting in a semiconductor shortage. The COVID-19 outbreak also wreaked havoc on the semiconductor supply chain. China is a major supplier of semiconductors; delays in supply due to the aforementioned factors have hampered the development of embedded systems.

Wednesday, September 21, 2022

Embedded Security Market Dynamics - Global Forecast to 2027

Subscribe to:

Post Comments (Atom)

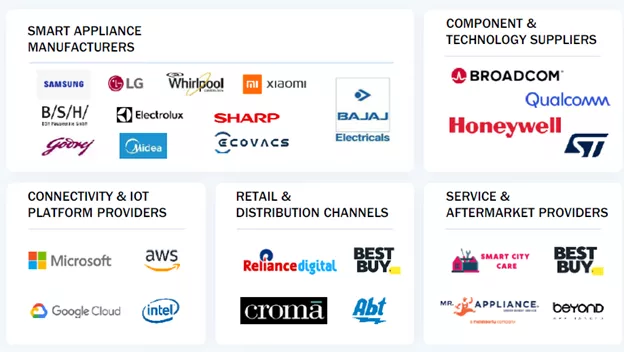

Smart Home Appliances Market: Revolutionizing Modern Living Through Connected Intelligence to 2030

The Connected Home Revolution Smart home appliances are becoming a central pillar of modern households as consumers increasingly adopt conne...

-

In the ever-evolving landscape of industrial automation, ensuring the safety of workers and machinery is paramount. Machine safety solutio...

-

The global 3D machine vision market is expected to be valued at USD 2.13 Billion by 2022, growing at a CAGR of 11.07% between 2017 an...

-

Major factors driving the market for AI infrastructure include increasing adoption of cloud machine learning platform, escalating demand f...

No comments:

Post a Comment