The report “Inductor Market by

Inductance (Fixed, Variable), Type (Wire wound, Multilayered, Molded,

Film), Core Type (Air, Ferrite, Iron), Shield Type (Shielded,

Unshielded), Mounting Technique, Vertical, Application, Geography –

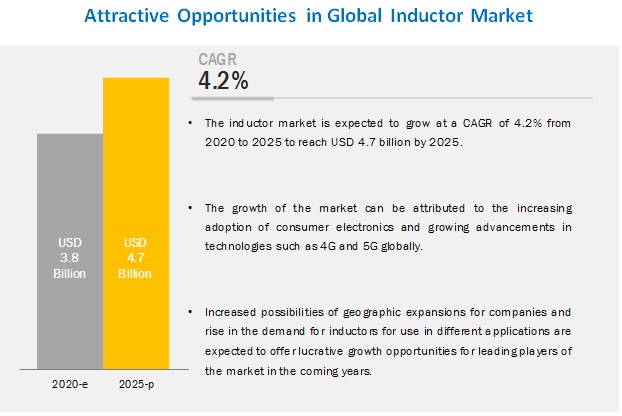

Global Forecast 2025″,is estimated to grow from USD 3.8 billion

in 2020 to USD 4.7 billion by 2025; at a CAGR of 4.2%. Major driving

factors of the inductor market are the increasing demand for consumer

electronics that require a large number of inductors and the rising

adoption of electric vehicles.

Browse 102 market data Tables and 45 Figures spread through 174 Pages and in-depth TOC on “Inductor Market – Global Forecast 2025”

Download PDF Brochure:

Fixed inductor market is fastest-growing market

Most

of the inductors used in the electronics industry are fixed inductors.

As the electronics industry is shifting toward small form factors, fixed

inductors are increasingly becoming popular, owing to their compact

design and lightweight. These inductors have coils that are wound in

such a manner that they remain fixed in a position. They are used in

filters, sensors, transformers, motors, energy storage systems, among

others. Fixed inductors can sustain in high temperatures and can operate

in extreme environments; hence, the demand for these inductors is

likely to increase in the near future.

Wire-wound inductors to hold largest share of inductor market in 2025

Wire-wound

inductors have a core made of magnetic metals such as iron or ferrite

with a wire wound around it. Unwanted radio frequencies can interfere

with the audio sound quality and disrupt electrical circuits. Hence,

wire-wound inductors are used as they can block or filter radio

frequencies. They are typically found in car audio systems and

electronic control units (ECUs) and also in electronic equipment used in

communication infrastructures and mobile base stations. They are mainly

used in the high-frequency circuits of mobile communication equipment,

such as wireless LAN, mobile phones, broadband components, RFID tags, RF

transceivers, Bluetooth, Wireless PDA, and security systems. Wire-wound

inductors are larger in size and their performance is twice than that

of multilayered inductors of the same size. Wire-wound inductors hold

the largest market share as the manufacturing cost involved is less

compared with other types of inductors and they provide a high

inductance value.

Automotive is fastest-growing vertical in inductor

Inductors,

used in automotive applications, have to operate under harsh

environmental conditions. They can be used in various applications such

as engine and transmission control units, LED drivers, HID lighting, and

noise suppression for motors. Advancements in the automotive industry

such as passenger comfort and safety, as well as environmental

considerations, require expanding electronics to accommodate the

decreasing available space. Inductors in the automotive industry are

used in applications such as EMI filtering of high-power lines and

energy storage for high-frequency DC-to-DC converters. In the automotive

sector, surface-mount power inductors are widely used. As an increasing

number of systems are becoming electrical instead of mechanical, a

large amount of current is required to be appropriately regulated and

filtered. Also, due to the adoption and increase in the manufacturing of

electric vehicles, the demand for inductors in automobiles has

significantly increased.

APAC to hold largest share of inductor market in 2025

The

growth of the inductor market in APAC is mainly driven by the growth of

the consumer electronics market in the region. APAC is witnessing

dynamic changes in terms of the adoption of new technologies across

various industries. As APAC has low labor cost, most of the inductors

are manufactured in APAC and are exported to various regions. There is

an extensive rise in the demand for power, which is increasing the need

for power management and thereby, accelerating the demand for inductors.

Request Free Sample Pages:

Key Market Players

Key

players in the market are Murata Manufacturing (Japan), TDK (Japan),

Vishay Intertechnology (US), TAIYO YUDEN (Japan), Chilisin (Taiwan),

Delta Electronics (Taiwan), Panasonic (Japan), ABC Taiwan Electronics

(Taiwan), Pulse Electronics (US), Coilcraft (US), Shenzhen Sunlord

Electronics (China), Bourns (US), Sumida (Japan), ICE Components (US),

AVX (US), Bel Fuse (France), Falco Electronics (Mexico), GCi

Technologies (US), Würth Elektronik (Germany), and Samsung

Electro-Mechanics (South Korea).

These

players are increasingly undertaking product launches and developments,

and acquisitions, to develop and introduce new technologies and

products in the market.

No comments:

Post a Comment